As such, your interest rate and payment differential will be smaller, possibly making your refinance less valuable. You can still refinance, but you won't get today's rock-bottom interest rate, but instead something slightly above the market. However, you are only paying them a little at a time, and depending upon how long you remain in the mortgage, they may cost you more or less than if you paid them right up front, as you would have in a traditional refinance.Ī "No-Cost" refinance might be your best bet if you don't have cash to spend or equity to use for your refinance. Since you are financing the costs, you'll not only pay them but also interest on them. This is a popular choice for homeowners who have some equity available and don't want to (or can't) come up with the cash needed to get a new mortgage. However, instead of you paying them today out-of-pocket, it adds them into the loan amount you are borrowing. The "Low-Cash-Out Refinance" calculation (LCOR) uses the Estimated Costs you plugged into the Traditional Calculator.

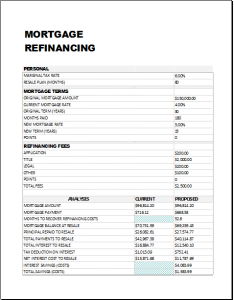

You pay the fees once, and then they are gone. We assume that the fee for refinancing will be approximately 2 points (2 percent of the loan amount) but if it is different, you can change it just type the expected dollar amount into the yellow box.

This is your breakeven point, and in order to get any real savings, you'll need to stay in the new mortgage beyond this point. While you get the benefit of the lower interest rate, you have to overcome your outlay today before you realize any benefit. The Traditional Refinance calculator assumes you pay the closing costs out of pocket today.

0 kommentar(er)

0 kommentar(er)